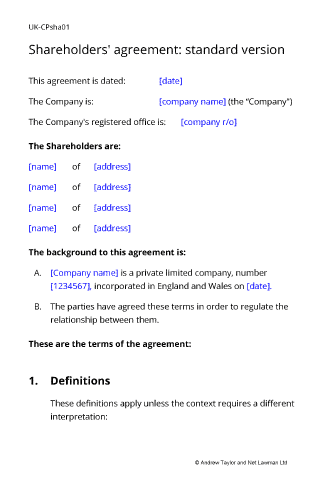

Shareholders' agreement

Document overview

England & Wales

England & Wales Scotland

Scotland

- Length:24 pages (6000 words)

- Available in:

Microsoft Word DOCX

Microsoft Word DOCX Apple Pages

Apple Pages RTF

RTF

If the document isn’t right for your circumstances for any reason, just tell us and we’ll refund you in full immediately.

We avoid legal terminology unless necessary. Plain English makes our documents easy to understand, easy to edit and more likely to be accepted.

You don’t need legal knowledge to use our documents. We explain what to edit and how in the guidance notes included at the end of the document.

Email us with questions about editing your document. Use our Lawyer Assist service if you’d like our legal team to check your document will do as you intend.

Our documents comply with the latest relevant law. Our lawyers regularly review how new law affects each document in our library.

About this document

A shareholders’ agreement is an essential document for the owners of any company. It rebalances control when there is different levels of involvement and power in day to day decisions, and protects the value and the interests of each party.

Not only should this template help you establish the strategic management structure you need to grow your business, but also ensure that your investment is protected when you or other owners decide to sell.

This template is our full standard version, suitable for most private limited companies regardless of the industry of the business or the number of shareholders. It could be put in place by a majority or a minority shareholder when the company is formed, or at any later time, for example, on change of ownership or when a significant debt investment is made or repaid.

Free to use

We provide this document free of charge as an example of the quality of our drafting.

There are no catches. Some of our competitors require you to subscribe to a paid monthly service only to have to cancel within days so as not to be charged. This really is a free download - we don't ask for your credit card information, and won't send you lots of marketing e-mail messages.

We hope that if you like the document, you might buy a different one from us in the future or use our document review service.

Contents

No other shareholders’ agreements for sale on the Internet are so comprehensive in their cover of legal issues, and the drafting explanations and tips supplied. This agreement has been carefully thought out and frequently updated over 15 years so as to give you a document that covers the law accurately but which, at the same time, helps you to avoid conflict in day to day practical areas of management and control.

In many areas, we give you complete alternative paragraphs and explain in the notes when each will be the most suitable for you.

Each provision is clearly worded and can easily be edited or removed without affecting the remainder of the document.

Examples of subjects covered are:

obligations of the company to the shareholders (the company is also a party to the agreement)

how shareholders will maintain their rights if they are not present at meetings

roles of directors and actions by the company or a director which require shareholders’ consent: controls and redistributes power between shareholders so that majority shareholders cannot force decisions

new shareholder rights and restrictions: even if he is a trustee in bankruptcy

special protection of a minority by specification of critical decisions that must be agreed by that shareholder

facility for a minority shareholder to appoint his or her own nominated director who cannot be removed by the others.

how to deal with new intellectual property

transfers of shares and rights of pre-emption or first refusal: when allowed, under what conditions and to whom

exit strategy

key man insurance

publicity about the deal

confidentiality

use of a shareholder’s own assets in the business

different valuation methodologies for the shares on the departure of a shareholder

Other versions of this agreement

We also offer shareholders agreement templates for specific situations. including where a single person owns the majority of the equity, and where shareholders include professional investors who require more complex exit provisions.

Recent reviews

Choose the level of support you need

Document Only

This document

Detailed guidance notes explaining how to edit each paragraph

Lawyer Assist

This document

Detailed guidance notes explaining how to edit each paragraph

Unlimited email support - ask our legal team any question related to completing the document

- Review of your edited document by our legal team including:

- reporting on whether your changes comply with the law

- answering your questions about how to word a new clause or achieve an outcome

- checking that your use of defined terms is correct and consistent

- correcting spelling mistakes

- reformatting the document ready to sign

Bespoke

A document drawn just for you to your exact requirements

Personalised service provided by an experienced solicitor

Free discussion before we provide an estimate, for you to ask questions and for us to understand your requirements

Transparent fees - a fixed fee for the basic work, a fixed hourly rate for new or changed instructions, and no charge for office overheads or third party disbursements

Careful and thorough consideration of your circumstances and your consequent likely practical and legal requirements

Provision of options that you may not have considered with availability for discussion

Help and advice woven into the fabric of our service so that you can make the best decisions

All rights reserved