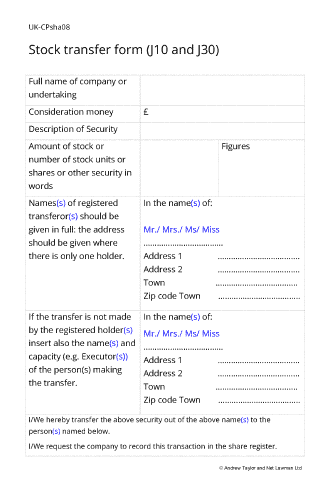

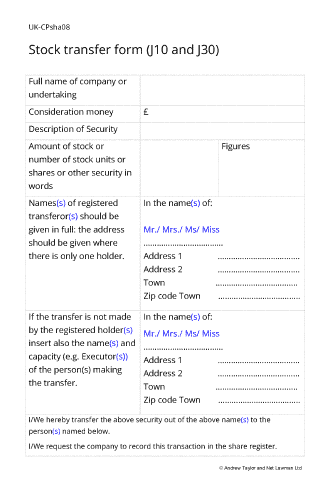

Stock transfer form (J10 and J30)

Document overview

England & Wales

England & Wales Scotland

Scotland

- Length:3 pages (860 words)

- Available in:

Microsoft Word DOCX

Microsoft Word DOCX Apple Pages

Apple Pages RTF

RTF

If the document isn’t right for your circumstances for any reason, just tell us and we’ll refund you in full immediately.

We avoid legal terminology unless necessary. Plain English makes our documents easy to understand, easy to edit and more likely to be accepted.

You don’t need legal knowledge to use our documents. We explain what to edit and how in the guidance notes included at the end of the document.

Email us with questions about editing your document. Use our Lawyer Assist service if you’d like our legal team to check your document will do as you intend.

Our documents comply with the latest relevant law. Our lawyers regularly review how new law affects each document in our library.

About this document

A share transfer form is a legal record of the change of ownership of company shares between two people or entities.

There used to be two types of transfer form: the J10 was used for two or more transferors and the J30 for where there was just one. Our form provides for one or two.

The form can be used to transfer ownership of any shares or other financial instrument in any private limited company (ltd) or public limited company (plc) incorporated in the UK.

How to use the form

Company law provides for a transfer form to be signed either by the transferor only, or by both the transferor and the transferee.

Because very few companies require the signature of the transferee, the older standard form of articles of association (known as "Table A") excludes the provision for two signatures.

For companies with articles drawn under the Companies Act 2006 (the model set), the requirement for two signatures has to be positively inserted. It is therefore very rare indeed.

If you manage a public company (plc) you should change your articles to the new style permitted under the 2006 Act. Most public companies use external registrars to manage their register of shareholders and almost all transactions take place through the Stock Exchange Electronic Trading Service, which does not use a system requiring any signature.

The transferor shareholder should complete the form with his own details then hand or post it to the new shareholder to complete his details. The form should then be sent to the secretary of the company with a request to issue a new share certificate. That certificate is proof of ownership of the shares. First, you should pay stamp duty.

Share transfers are taxed at a rate of 0.5% of the consideration for the shares, rounded to the nearest £5 and subject to a minimum of £10. If the shares were bought for less than £1,000 then the form does not need to be presented to HMRC for stamping.

If the value paid (actual or ad valorem) is greater than £1,000 you should calculate the duty payable and send the payment and the share transfer form to HMRC for stamping. There are other exemptions to the need to pay duty, which are covered in the guidance notes provided.

Once the share transfer form has been stamped by HMRC (if necessary), a new share certificate can be issued to the new shareholder. The transferor's old share certificate should be returned to the company for cancellation. The record of the new shareholder will appear in the next annual return filed for the company.

There is a legal requirement to update the company's register of transfers and register of members immediately.

You should note that the Registrar of Companies has no authority to compel any part of the transfer procedure. What is submitted in the annual return will be taken as fact unless some person proves it is false. In a legal action, the judge will not take note of a share transfer on which stamp duty due has not been paid.

The law relating to this document

There is no statutory legal requirement to use a particular template over another. The key is to ensure that the correct information is included.

This stock transfer form complies with both the Companies Act 2006 and the 2008 Finance Act (though neither specify any particular requirement).

Recent reviews

Choose the level of support you need

Document Only

This document

Detailed guidance notes explaining how to edit each paragraph

Lawyer Assist

This document

Detailed guidance notes explaining how to edit each paragraph

Unlimited email support - ask our legal team any question related to completing the document

- Review of your edited document by our legal team including:

- reporting on whether your changes comply with the law

- answering your questions about how to word a new clause or achieve an outcome

- checking that your use of defined terms is correct and consistent

- correcting spelling mistakes

- reformatting the document ready to sign

Bespoke

A document drawn just for you to your exact requirements

Personalised service provided by an experienced solicitor

Free discussion before we provide an estimate, for you to ask questions and for us to understand your requirements

Transparent fees - a fixed fee for the basic work, a fixed hourly rate for new or changed instructions, and no charge for office overheads or third party disbursements

Careful and thorough consideration of your circumstances and your consequent likely practical and legal requirements

Provision of options that you may not have considered with availability for discussion

Help and advice woven into the fabric of our service so that you can make the best decisions

All rights reserved