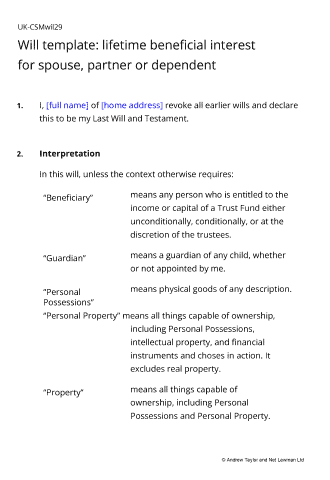

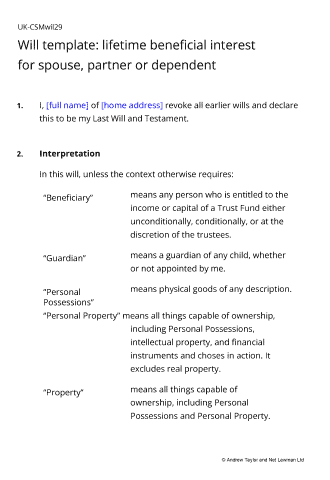

Will template

Document overview

England & Wales

England & Wales

- Length:13 pages (3020 words)

- Available in:

Microsoft Word DOCX

Microsoft Word DOCX Apple Pages

Apple Pages RTF

RTF

If the document isn’t right for your circumstances for any reason, just tell us and we’ll refund you in full immediately.

We avoid legal terminology unless necessary. Plain English makes our documents easy to understand, easy to edit and more likely to be accepted.

You don’t need legal knowledge to use our documents. We explain what to edit and how in the guidance notes included at the end of the document.

Email us with questions about editing your document. Use our Lawyer Assist service if you’d like our legal team to check your document will do as you intend.

Our documents comply with the latest relevant law. Our lawyers regularly review how new law affects each document in our library.

About this document

This last will and testament template gives you control over who ultimately receives your estate.

After bequests and legacies, the estate is put in trust for a lifetime beneficiary. That beneficiary might be your wife, husband, or partner or someone else who is dependent on you.

The lifetime interest ends when the beneficiary dies or some other condition is met (such as remarrying, living with another partner or a child reaching adulthood), and the estate is then given to one or more others. If some of the ultimate beneficiaries are your children and under 18, then their share of your estate remains in trust.

We use our own Net Lawman trust provisions in this template (adapted from STEP provisions) to give you maximum flexibility and control of how the trust is managed.

You can read more about trusts in general or specifically about life interests.

Like other Net Lawman will templates, there are provisions for legacies and bequests to be made to specific people before the estate is put into trust, and provisions for matters such as appointing guardians for children under 18.

Who should use this template?

The key feature of this will template is that the lifetime beneficiary of the trust doesn’t inherit your residual estate, but merely benefits from it while conditions are met. Of course, you could also separately bequeath money or possessions to that person so that they do inherit something from you.

Most commonly, we envisage that this template would be used by someone who:

wishes some of his or her estate to “skip a generation” to take full advantage of nil rate bands for inheritance tax, but still wishes to support a wife, husband or partner while he or she is alive (and possibly single);

wants to ensure that children from earlier relationships are not disinherited, but still wishes the estate to support a current wife, husband or partner during his or her lifetime;

wants the estate to support a dependent while help is needed before being distributed between a number of people.

This template is suitable for a man or for a woman - it isn't gender specific. We follow normal, modern legal convention of using the masculine form of a word regardless of the gender of the person.

This template can be used for basic inheritance tax planning (largely as illustrated by HM Revenue and Customs), but we do not provide guidance on the subject. If the value of your estate could exceed the nil rate band then we suggest that you seek advice from a qualified tax specialist before signing your will.

The nil rate band is £325,000. If you leave your home to a direct descendant, then it increases by £175,000.

The law in this will

The law on wills is varied but precise. This will provides flexibility within that precise legal framework. The Net Lawman trust powers in this document free the trustees from some of the bonds of the Trustee Act 2001 that are unsuitable for trusts managed within your family and by professional advisers.

The law on wills can seem complicated. We have prepared a number of short articles to explain the more difficult legal concepts. You may like to read some of our articles on writing your own last will and testament.

When to use this will

You can write a will at any time in your life. Most people consider a new will when their financial circumstances change, or when relationships change. The Law Society advise that you review you will every five years, and that you make a new will after a major life change such as having a child, marriage, separation or divorce. It is possible to change a will without making a new one, but a new one is usually the preferable option.

Document features and contents

- Revocation of all earlier wills

- Appointment of executors and trustees

- Legacies (gifts of money)

- Bequests (gifts of possessions)

- Instruction to executors to gather in assets

- Gift over provision if the beneficiary does not survive you by more than a given time

- Options for small bequests and legacies to children without involving a trust

- Creation of a trust holding the residual value of the estate (using flexible trust provisions that you can change to suit how you want the trust to work)

- Payments to executor(s)

- Warning to executors on valuations

- Alternative wishes for burial / cremation / use of your body for advancement of science

- Appointment of guardians for children

- Signatures and witnesses

- Example letter of intent

Recent reviews

A trust will.

Protecting everyone involved.

I'm impressed with the review service. I have peace of mind.

Yes, I would recommend, very good responses to my questions.

Being able to preview the document allayed my concerns and I also messaged NetLawman with a couple of queries and they got back to me very quickly.

I needed to be able to edit the document to offer a limited time interest in a property rather than whole life and I was able to do this - unlike other services the entire document can be edited to meet your needs.

Doing it this way gave me a document that net NY needs without the needless expense of getting it personally drafted by a solicitor.

I would use this service as my first stop for future needs.

Thank you!

Choose the level of support you need

Document Only

This document

Detailed guidance notes explaining how to edit each paragraph

Lawyer Assist

This document

Detailed guidance notes explaining how to edit each paragraph

Unlimited email support - ask our legal team any question related to completing the document

- Review of your edited document by our legal team including:

- reporting on whether your changes comply with the law

- answering your questions about how to word a new clause or achieve an outcome

- checking that your use of defined terms is correct and consistent

- correcting spelling mistakes

- reformatting the document ready to sign

Bespoke

A document drawn just for you to your exact requirements

Personalised service provided by an experienced solicitor

Free discussion before we provide an estimate, for you to ask questions and for us to understand your requirements

Transparent fees - a fixed fee for the basic work, a fixed hourly rate for new or changed instructions, and no charge for office overheads or third party disbursements

Careful and thorough consideration of your circumstances and your consequent likely practical and legal requirements

Provision of options that you may not have considered with availability for discussion

Help and advice woven into the fabric of our service so that you can make the best decisions

All rights reserved