Statutory demand form and notes

Document overview

England & Wales

England & Wales

- Length:2 pages (3000 words)

- Available in:

Microsoft Word DOCX

Microsoft Word DOCX Apple Pages

Apple Pages RTF

RTF

If the document isn’t right for your circumstances for any reason, just tell us and we’ll refund you in full immediately.

We avoid legal terminology unless necessary. Plain English makes our documents easy to understand, easy to edit and more likely to be accepted.

You don’t need legal knowledge to use our documents. We explain what to edit and how in the guidance notes included at the end of the document.

Email us with questions about editing your document. Use our Lawyer Assist service if you’d like our legal team to check your document will do as you intend.

Our documents comply with the latest relevant law. Our lawyers regularly review how new law affects each document in our library.

About this pack of forms

A statutory demand can be an incredibly powerful debt collecting device. The law assumes it merely paves the way for a bankruptcy petition, but the threat alone can spur repayment from the most obstinate debtor. Used under the right circumstances, you shouldn’t need to go any further than issuing the initial paperwork.

Furthermore, the procedure to issue a demand is very easy to follow. Using one of these forms, the guidance and the letter in this pack you should be able to issue a demand yourself without needing to involve solicitors or pay court fees.

You can use this form and guidance to serve a notice on any individual. If you are trying to recover debts from a business partnership (but not a limited liability partnership or LLP), you can serve the notice on any partner as if you were recovering the debt from an individual. It is usual to pick the most senior partner, but you can pick any. Just make sure you pick a person who does have the wealth to repay you.

If you are trying to recover debts from a company or a limited liability partnership, then these forms are more suitable.

The format of these forms

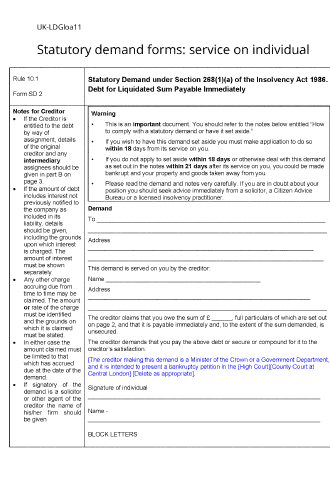

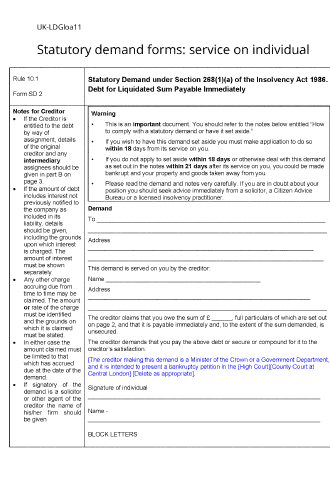

We provide you with two versions of form SD2 10.1 under section 268(1)(a) of the Insolvency Act 1986.

Rule 10.1 of the Insolvency (England and Wales) Rules 2016 provides list of matters that the demand must contain.

Some of the text in the forms is laid down in the Insolvency (England and Wales) Rules 2016, a, and therefore must be left precisely as it is. We have made clear what that is.

The format and layout are not laid down, so we are able to provide our own user friendly version of the form.

When to serve a debtor

Demands are not served as often as they could be. A common misconception is that a solicitor is needed to prepare the forms, or that it is a difficult process or that serving one is a certain path to litigation. In fact, in the right circumstances it is a fast and efficient way of collecting a debt that can be undertaken by anyone.

The key is that your debtor has to believe that you will take the process further to bankrupt him if he fails to pay. We advise that you should take that step if you need to do so, but you will find that in most cases you will not have to go further than a statutory demand. Now consider these points:

- By law, the debt must be at least £750. There is no cost or filing or registration necessary.

- But if your debtor is to believe you will bankrupt him, you have to make him see that it will be worth your while. The bankruptcy petition minimum amount is £5,000 for an individual. Therefore, if you use statutory demand on debts less £5,000 on a debtor who knows the rules knows that if they fail to pay a statutory demand it does not matter as you cannot follow through with a bankruptcy petition. So we suggest that the minimum amount that you should pursue is £5,000.

- You will not be paid if your debtor truly does not have the money. However, it is amazing how money is found when a creditor really presses hard.

- You have to be certain that what is owed is a simple money debt. You cannot issue a statutory demand for a case that could need a judge to decide.

- It goes without saying that you should not expect to have an on-going relationship with the debtor.

- You should reckon that your debtor is likely to repay you rather than risk his reputation. This is true of most people who borrow for personal use (such as a mortgage) but it is also true of people who run a business that relies on credit.

Pack features and contents

We provide two versions of the forms:

- The “traditional” Government form in Microsoft Word format to complete on your computer and then print

- Our own version, which we believe is easier to complete on your computer

There is full example text completed in our version to guide you with the wording you might use.

Also included in the pack are:

- Guidance notes to help your further on how to complete the forms and serve notice

- An example letter you might send to your debtor with the form

Recent reviews

My new debt recovery company is off to a flying start so I am sure I will be dealing with you again and again.

All I can say is many thanks to you all. 10/10 for your service!!!

All rights reserved